Tech cross-border M&A sustained bullish pace in 2020 according to data from Velocity Global and Pitchbook

Denver, Colo.

|

February 18, 2021 07:02 AM Mountain Standard Time

Denver, Colo.

|

February 18, 2021 07:02 AM Mountain Standard Time

Cross-border IT M&A deal values in 2020 equaled that of 2019, outpacing overall global IT M&A deal value, which was down year-over-year. That data provided by Pitchbook was reported today in the Cross-Border M&A Monitor: Tech Sector published by Velocity Global, the leading provider of global expansion solutions.

“Cross-border IT M&A accelerated significantly the second half of 2020 after dealmakers briefly paused at the onset of the pandemic,” said Rob Wellner, Velocity Global chief revenue officer. “Armed with more than a trillion dollars in dry powder at the end of 2020, PE firms represented a record share of the overall volume and helped bolster the deal count. We expect the surge to persist throughout 2021 and drive the need to close fast, move efficiently, and remove roadblocks to close.”

Cross-border IT M&A Resilience

Cross-border IT M&A remained integral to company growth plans. In 2020, cross-border IT M&A deal value topped $200 billion, approximately the same as the year prior. Furthermore, the cross-border IT deal count paced closely with a record-setting 2019 (1,326 transactions in 2020, 1,551 in 2019).

These figures indicate COVID-19 only impacted a brief pullback in Q2 and did not dissuade dealmakers from paying up for transactions.

“The global surge in demand for tech services driven by COVID-19 accelerated growth and M&A deals in the tech sector,” observed Wellner. “Remote work, digital health, and e-commerce exploded in 2020 and drove deal activity to keep pace or capitalize on an opportunity to serve enterprise and consumers alike.”

Software, IT Services, and Telecommunications top deal sectors

At the macro-level, software closed more deals and generated more deal value than any other IT subsector. However, both IT services and telecommunications saw significant spikes in deal value in the past two years. The same held true year over year for cross-border activity.

Europe Remained Most Resilient Region; U.S. Tech Giants Bolstered Global Dealmaking

Europe remained the most resilient region for cross-border tech M&A. For the second straight year, cross-border M&A value eclipsed $100 billion in Europe, and the region continued to dominate volume with approximately 800 deals (60% of overall cross-border tech volume). This resilience was driven by cyclical consolidation in sectors such as enterprise software and telecommunications. M&A also remained an attractive access point to markets across the continent.

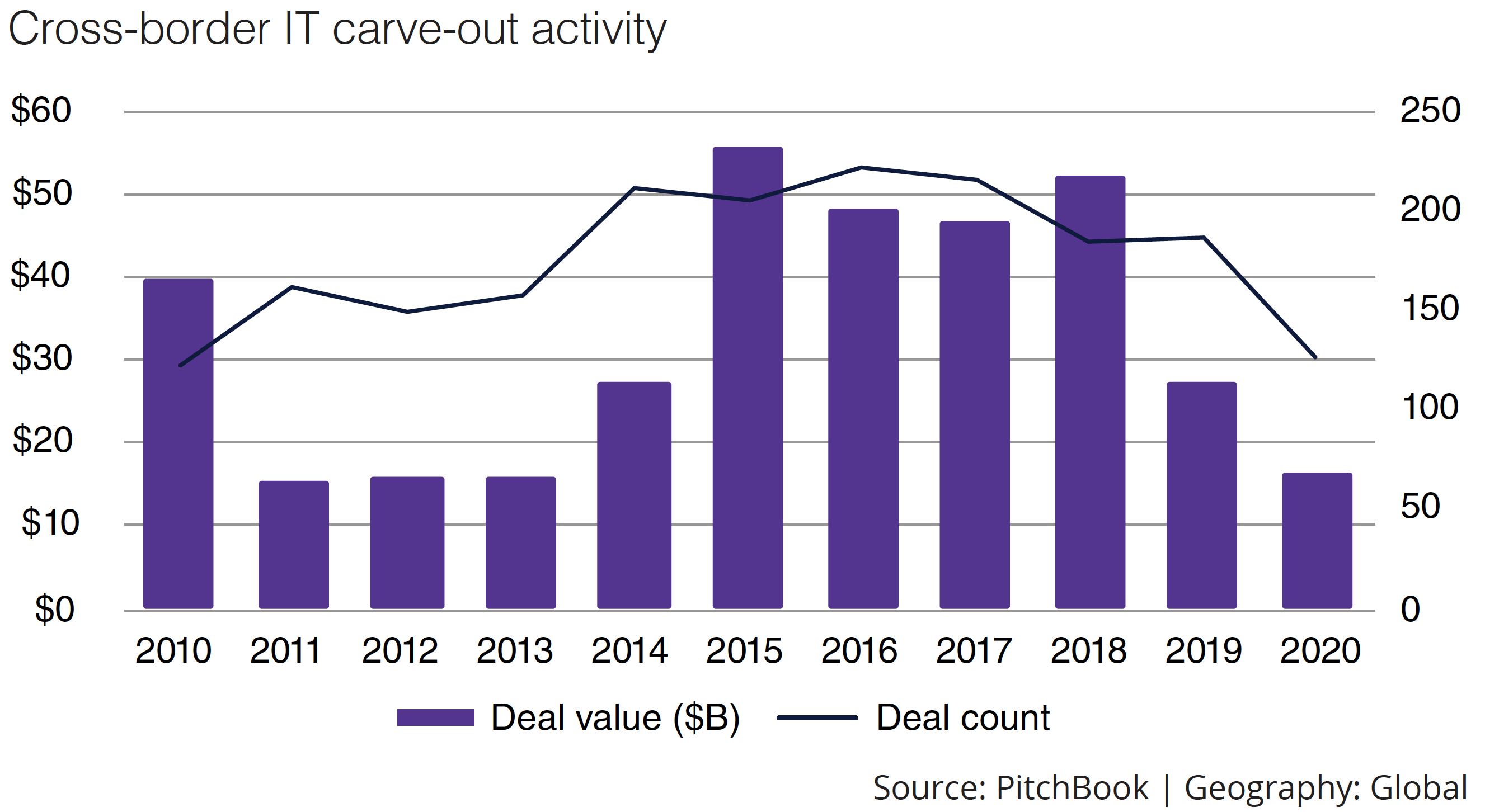

Cross-border Carve-outs Remain Complex

2020 cross-border IT carve-out M&A volume was just two-thirds of 2019, and these deal values dropped for a second year in a row. Software deals drove the decline in average cross-border carve-out deal size. The proportion of software carve-outs dropped by almost half from 2019 to 2020, with aggregate value falling by roughly two-thirds.

Carve-outs are more complicated than outright, wholesale acquisitions. The need to ensure proper integration plans, conduct operational and financial due diligence, assess isolated financials, as well as overall technology risks in terms of licensing, and transition service agreements (TSAs) make carve-outs extremely complex. Given the geopolitical landscape and the trend toward pricier acquisitions, intellectual property and rights agreements that necessitated daunting TSAs made it more difficult to justify spending significant sums on individual business units or divisions, particularly in software, rather than on outright M&A or in-house development.

Hurdles Remained

The pandemic presents additional challenges to existing complexities for prospective cross-border buyers and sellers. From a personnel perspective, immigration and recruiting to maintain or grow talent levels are logistically and operationally complex. Nondomestic regulations also thwart nondomestic direct investment and derail deals. Post-merger integration takes longer due to remote communications. Given these hurdles, there was an increased caution brought on by COVID-19, and M&A went forward primarily for safer prospects.

Added Wellner, “Companies must prioritize the ‘human element’ in a cross-border transaction. They must solve for employee onboarding, country-specific regulations, and legal jurisdiction management to minimize operational risks and accelerate market entry. Instead of creating foreign entities, companies increasingly implement a flexible solution like International PEO to avoid complicated TSAs, close quickly, and create a competitive advantage.”

Download the Cross-border M&A Monitor: Tech Sector here.