Marketers differ on the metrics that matter for live events, finds new research from Elevate Research explores the gap between current practice and measurement standards available across other marketing mediums, and the lack of industry cohesion on the metrics that matter

Los Angeles, California

|

May 09, 2022 09:30 AM Eastern Daylight Time

Los Angeles, California

|

May 09, 2022 09:30 AM Eastern Daylight Time

As international pandemic-related restrictions ease and large-scale events like festivals, international football and rugby tournaments are set to take place, event marketers are eager to get restarted but they will need to justify their budgets.

Global staffing partner for brand experiences Elevate commissioned a Censuswide survey of 500 brand decision-makers across the UK, USA, Austria, France and Germany, to understand the metrics that matter to marketers around event activations, and whether they currently have the same understanding of event effectiveness as other marketing activities.

By encouraging event marketers to be more demanding in terms of measurable KPIs and evaluated ROI, Elevate hopes its findings will be a game-changer for reporting in the events sector.

Most valuable KPI metrics

The highest interest is in Net Promoter Score (NPS), Total Purchase Value (TPV) and Visitor Satisfaction Score - data points rarely collected at events. On a country basis, NPS is most valued by the UK as a KPI (29% versus overall 25%). A third (33%) of marketers across the UK favour brand preference score (versus competition) as the most important of KPIs. This is in comparison to other key metrics such as event footfall (20%) and visitor satisfaction score (21%).

For larger companies with over 5000 employees, ROI, brand recall score and total purchase value are the most important to them at 50% respectively.

Digging into sector-specific trends, retail brands care most for TPV at 47.3%, suggesting that generating immediate sales and optimising the value of these transactions is what is most important to retailers. Whereas for FMCG, it’s the brand preference score that matters the most, at 47% - as most people buy from FMCG brands they prefer, or already know about, so metrics relating to retention or persuading customers to switch are all important.

The value of proving face to face interaction is particularly high for Brits in the tech sector - 67% of those in tech in the UK valued this metric most highly versus 30% in tech across regions.

Important functionality choices

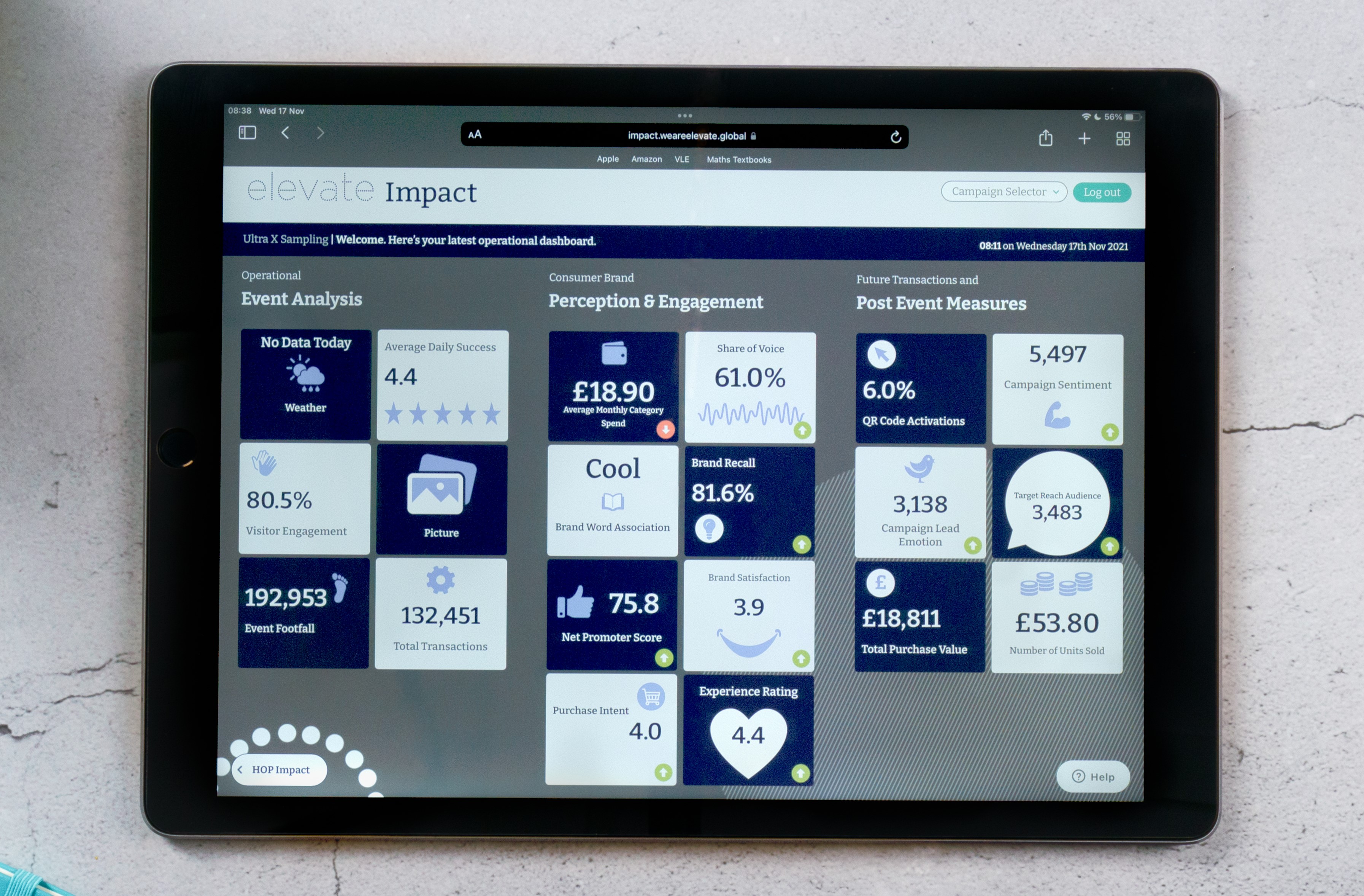

Marketers are divided on how they want to see data. 25% of all respondents would like an easy-to-read on-screen dashboard. Another quarter would prefer benchmarking options in order to track data results against predicted values. Event marketers need to show how their activations work alongside other marketing activities, as well as the impact of the investment.

All companies favoured social media monitoring post-event the least (13%). This may be due to the fact that, although post-event social media offers immense value, it only records sentiment, and this cannot be presented to a board of directors as a hard sales-related metric.

Smaller companies favour UX functionalities, 75% of companies with less than 500 employees would like an easy-to-read on-screen dashboard, while larger companies prefer benchmarking options, pre, during and post-event data tracking abilities, the ability to produce high-quality reports for department heads, and customisation to add bespoke metrics important to the brand’s objectives (50% respectively).

Ed Wood, CEO at Elevate, commented: “It’s clear that there is little industry alignment in terms of how events should and can be measured. Whilst allowing for every event working to different goals, it’s clear that there is room for greater understanding of what’s possible in event measurement across the board.

“This is why it was important for us at Elevate to create Impact, a technology platform that enables events, both online and in-person, to be quantitatively measured through the power of live data, offering marketers access to new insights that are being captured for the first time. We have seen it work with clients such as the UK government, and we are now looking forward to a time where data collection at all levels of an event becomes more targeted and receives the investment and focus it merits.”

Methodology

The research was conducted by Censuswide, with 500 brand decision-makers from the Alcohol, Beauty, FMCG, Retail and Technology categories in UK, USA, Austria, Germany and France. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles.

About Elevate

Elevate is an award-winning global event staffing agency that connects people with brands. We lead the industry by enriching brand-consumer relationships through positive human connections. In the highly competitive world of experiential staffing, Elevate stands head and shoulders above other agencies and are the only truly global events staffing agency with offices in London, Paris, Berlin, Austria and Los Angeles.

We partner with clients from around the world to deliver lasting moments of engagements via marketing agencies such as Jack Morton, Havas, McCann, NCompass and Octagon and working with brands such as Facebook, Jägermeister, Oculus, Boots Walgreens Alliance and EA Games amongst others.

Contact Details

Bilal Mahmood

+44 7714 007257

b.mahmood@stockwoodstrategy.com

Company Website